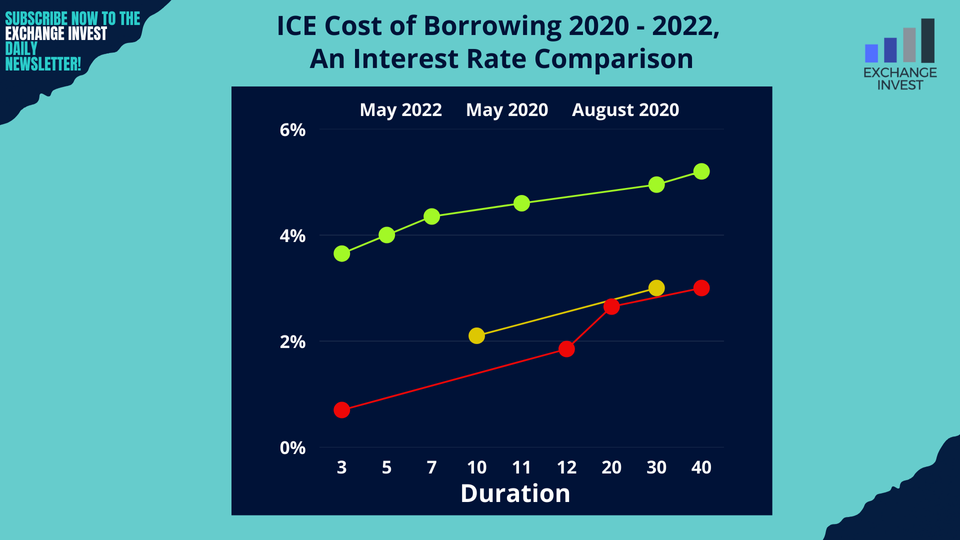

ICE Cost of Borrowing 2020 - 2022

Here’s a simple comparison which illustrates the end of the funny money era of QE and how interest rates have already had a major lurch up from their previous region of zero to, even negative, levels.

Taking a blue chip borrower from the parish of exchanges it makes for a fascinating comparison. InterContinental Exchange has, if anything, a better balance sheet now than 2 years ago. Certainly, their credit is at the very very least, the same as it was when they first borrowed.

The bottom 2 lines show their costs of borrowing in the bond market in May and August 2020. The rates are - to put it mildly - astonishing by historical comparison, such as that 0.7% 3 year money which is now a 3.65% coupon (fabulous by long-term standards but a vast leap from the QE lows of Covid-crazed 2020).

The 2.1% 10 year notes issued in May 2020 replaced an expiring 2.7% tranche whereas now a 10 year tranche is essentially 4.6% - albeit at 11 not 10 years to maturity…

However you look at these numbers - and again ICE is just a useful proxy given its strong balance sheet - we can easily perceive its cost of borrowing is reflecting the underlying interest rate market. Thus the key takeaway is that corporate debt levels have leapt compared to where they were as Covid enveloped the world and the last QE era mega-pump prime took place.

So, as one take away is that even a great cashflow business with little fundamental risk is suddenly borrowing at significantly higher rates, what does that do for those with a less adequate balance sheet? Indeed if those companies’ balance sheets look a bit sparse around the edges, just how high is their borrowing cost going? …And how far through the forest of firms pending refunding soon do we need to go before we reach those who either cannot borrow at these higher rates or cannot sustain their business while repaying? (Either way, the outlook is grim - if they cannot refund or they cannot repay it’s essentially a rendezvous with the grim reaper of restructuring, if not outright liquidation).

Where a good company like Intercontinental Exchange can take this interest leap in its stride, the reality is a lot of other companies will be squeezed and a load of zombies who have managed to survive through the QE era are now staring at a serious predicament whenever they need to rollover their debt.

P.S. If you are passionate about markets like us, perhaps you could help spread the word about our content pertaining to the business of bourses?

At the least can you like this article, or leave us a comment, we welcome your feedback.

Member discussion